Managing Recurring Payment Delays: Strategies for Ensuring Timely Client Invoices

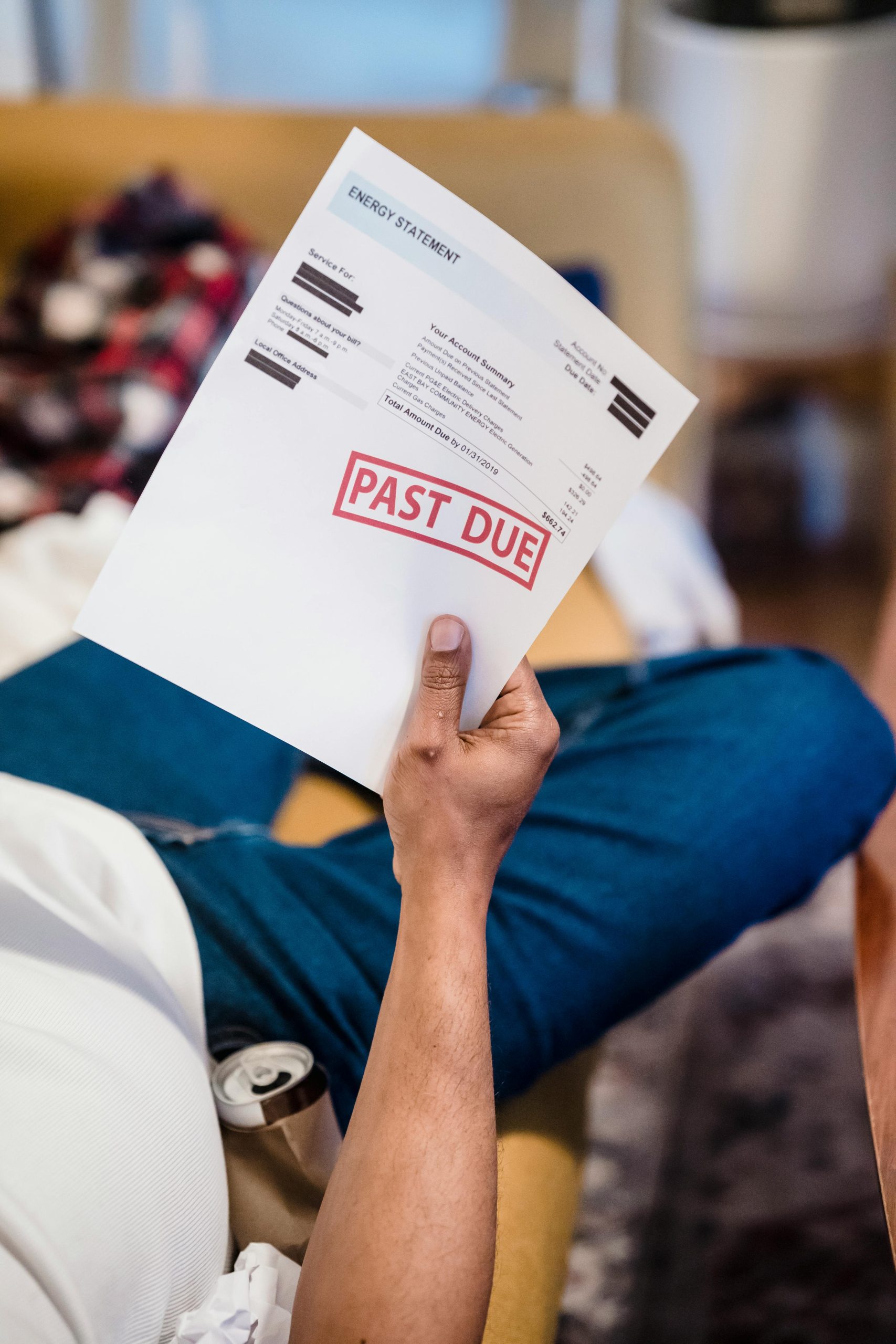

In the realm of freelance work and service-based businesses, maintaining a steady cash flow is paramount. A common challenge many entrepreneurs face is delayed invoice payments from clients. Recently, I encountered a situation where a longstanding client has consistently paid their invoices well past the due date, despite automated reminders. Over the past two years, they’ve been billed quarterly but have repeatedly paid approximately 40 to 50 days after receiving their invoice. This pattern has begun to impact our financial planning and operational stability.

Understanding the Impact of Payment Delays

Delayed payments can create significant strain on a business’s cash flow, making it difficult to meet ongoing expenses, invest in growth, or plan ahead. In my experience, even reliable clients can sometimes fall behind due to internal processes or unforeseen circumstances. However, persistent delays, especially over an extended period, necessitate a proactive approach to resolution.

Strategies to Address Recurring Invoice Delays

-

Enhance Communication and Clarify Payment Terms

It’s beneficial to revisit the initial agreement and ensure that payment terms are clearly outlined and mutually understood. Sometimes, emphasizing the due date and consequences of delayed payment can prompt more timely remittance. -

Implement Clear Payment Policies and Penalties

Introducing late payment fees or interest charges for overdue invoices can serve as an incentive for clients to prioritize payments. Ensure these policies are communicated upfront and reflected in the contract. -

Offer Flexible Payment Options

Occasionally, clients face cash flow issues that hinder prompt payment. Providing alternative payment methods or installment plans might facilitate smoother transactions. -

Automate and Follow Up Strategically

While your current system includes automatic reminders, consider integrating more personalized follow-up communications. A direct conversation or email to understand any challenges they face might reveal underlying issues and foster goodwill. -

Negotiate and Build Stronger Relationships

Establishing a rapport and open dialogue can lead to mutually beneficial solutions. If late payments are a recurring problem, negotiate revised terms that are more manageable for both parties. -

Consider Adjusting Billing Frequency

If quarterly billing consistently leads to delays, exploring monthly invoicing or milestone-based payments may help distribute the financial burden more evenly and encourage timeliness. -

Evaluate the Cost-Benefit of Continuing the Relationship

In cases where repeated delays persist despite proactive measures, it may be necessary to reassess ongoing engagements and consider