Understanding Financial Insights for Your Business: A Brewpub’s Experience

In today’s fast-paced business world, having a clear grasp of your financial situation is vital. But how do small business owners collect and analyze financial information effectively?

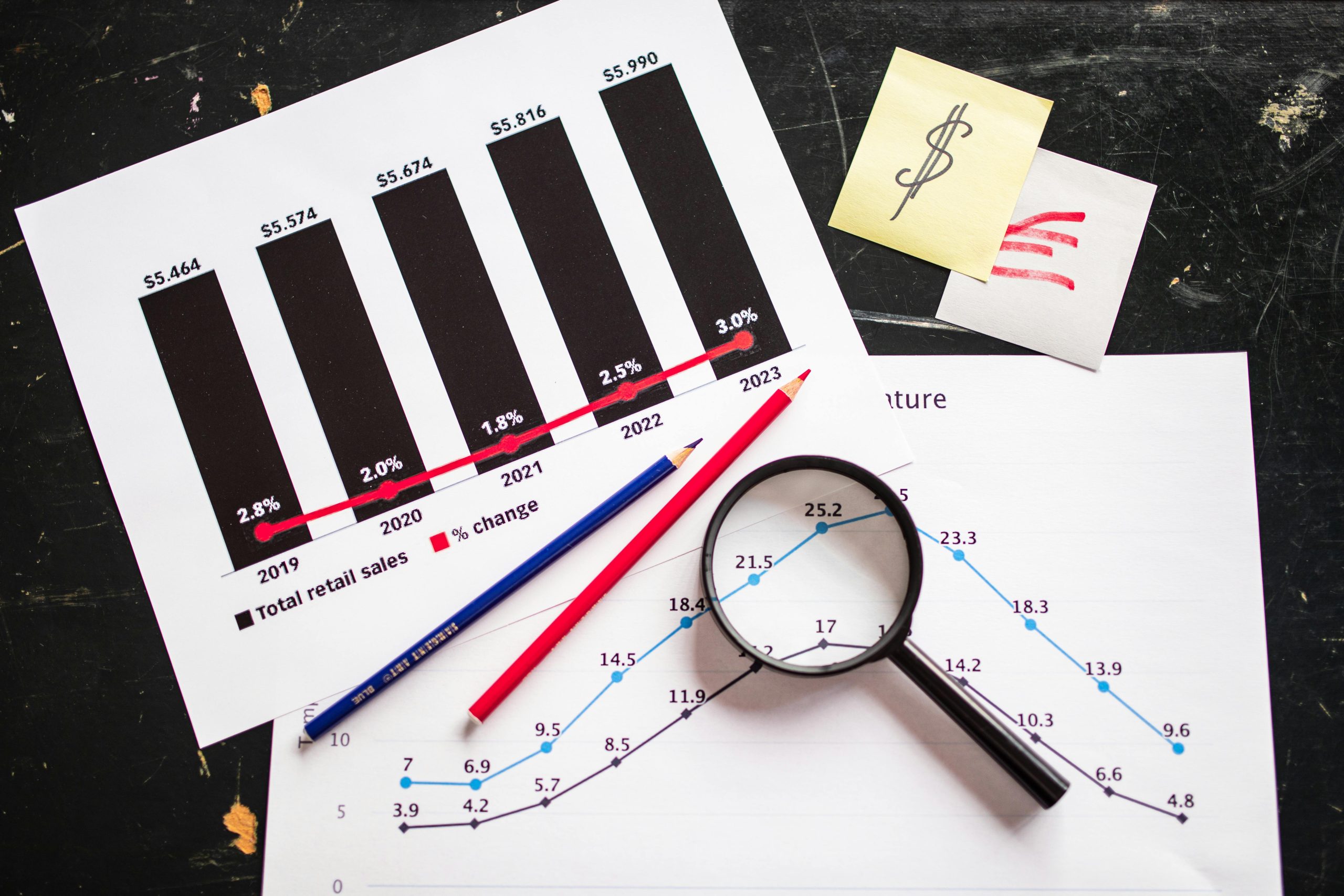

Take, for instance, my brother-in-law, who operates a cozy brewpub. He and his partners invest more than 20 hours every month wrestling with QuickBooks and spreadsheets to decipher their financial landscape. Their primary concerns revolve around essential questions such as, “Which menu items are the most popular?” “What profit margins are we achieving on various beers?” and “Should we pursue a bigger client for payment to prevent cash flow issues next month?”

What struck me was the limited role his accountant plays in this process. For approximately $10,000 annually, you’d expect more than just the basic tax filings. The absence of proactive financial analysis made me wonder about how other businesses tackle similar challenges.

So, how do you manage your financial insights? Is there someone on your team providing support in this area? Does your accountant offer assistance beyond just annual tax returns? I’m particularly curious about more granular data, like the profitability of different offerings or the month-to-month shifts in cash flow.

Or perhaps such detailed analysis is not a priority for many businesses? I’d love to hear your thoughts and experiences. How do you navigate the financial intricacies of your enterprise?