How to Effectively Handle Unpaid Invoices for Large Contracts: Strategies for Business Owners

Managing client payments is a crucial aspect of maintaining healthy cash flow and ensuring business sustainability. Unfortunately, overdue payments can pose significant challenges, especially when dealing with substantial invoices. If you find yourself in a situation where a client has not settled an invoice—such as a contract exceeding £30,000—it’s important to approach the matter professionally and strategically.

Understanding the Situation

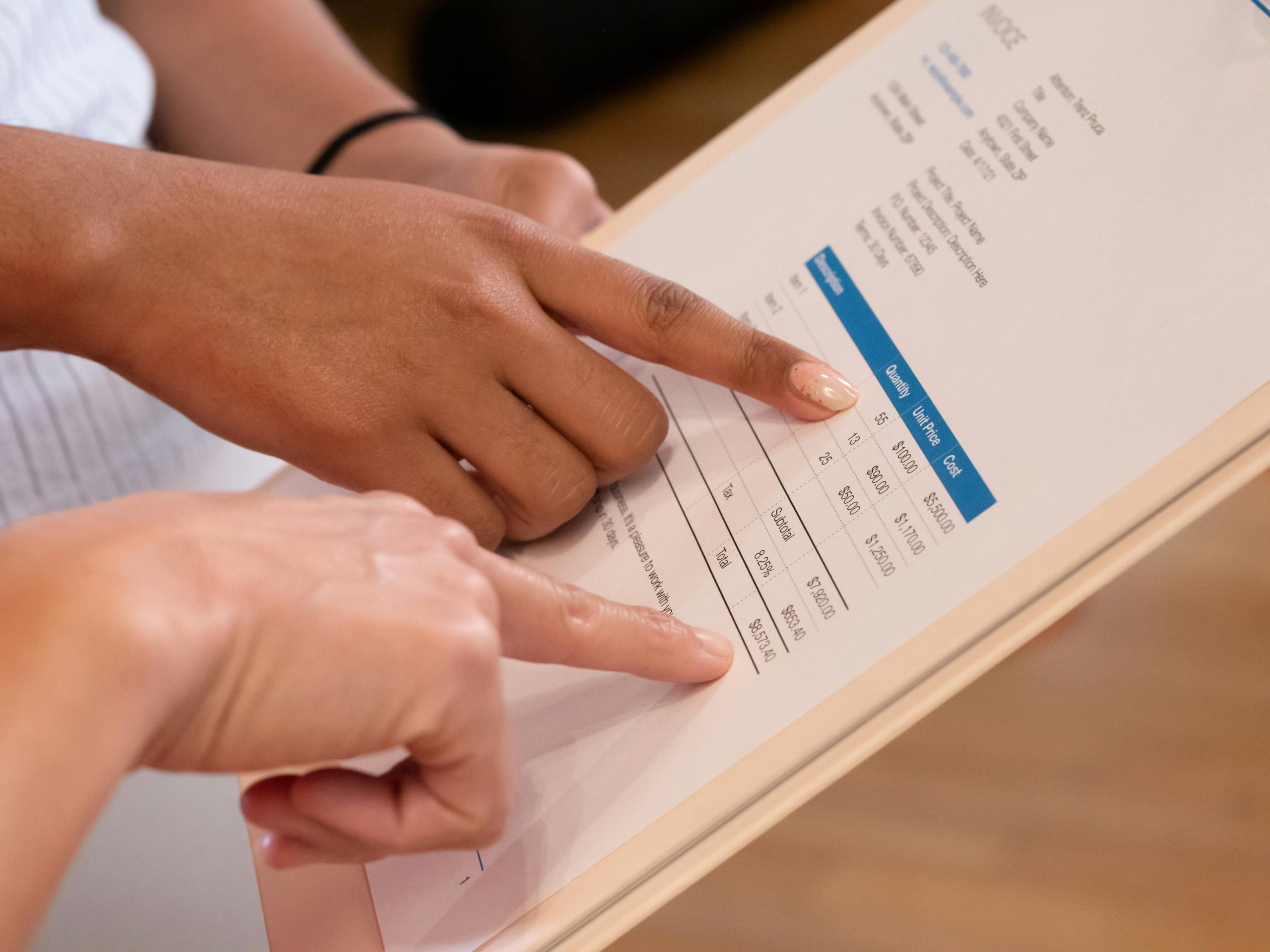

Imagine a scenario where a business has completed a significant project, with the contract value surpassing £30,000. Despite delivering on their commitments, the client has failed to pay the outstanding invoice, which dates back to work carried out in December and January. This situation not only affects cash flow but can also lead to a sense of frustration and concern about recovering the owed funds.

Initial Steps to Address Unpaid Invoices

-

Open a Line of Communication

Begin with a courteous yet firm reminder. Sometimes, overdue payments are due to oversight or administrative delays. Contact the client via email or phone, referencing the invoice number, date, and amount owed. Clarify any issues and confirm that the invoice has been received and understood. -

Document All Correspondence

Maintain a written record of all communications related to the overdue invoice. This documentation will be critical if further action becomes necessary. -

Offer Payment Options or Solutions

In some cases, clients may be facing cash flow difficulties. Consider proposing payment plans or extensions if appropriate, which can foster goodwill and expedite settlement.

When to Escalate the Matter

If initial communication attempts are unsuccessful, and the client continues to delay payment, it may be time to escalate the situation:

-

Send a Formal Debt Reminder or Letter of Demand

A professionally drafted letter outlining the amount owed, the deadline for payment, and the consequences of non-compliance can prompt action. This letter should be clear, concise, and firm. -

Seek Mediation or Alternative Dispute Resolution

Before pursuing legal action, consider engaging a mediator to facilitate an agreement. This approach can be more cost-effective and quicker than legal proceedings. -

Legal Action: Small Claims Court or Debt Recovery

If all else fails, the next step may involve legal avenues such as small claims court. While this process can be time-consuming, it is an effective method to recover substantial sums, especially for large contracts.

Proactive Measures for Future Contracts