Understanding Asset Depreciation for Business Acquisitions: HVAC Units, Shelving, and Merchandising Displays

When acquiring a new business, it’s important to understand how to handle the depreciation of existing assets. This not only affects your tax obligations but also provides a clearer picture of your company’s value. If you’ve recently purchased a retail store equipped with HVAC systems, shelving, and gondolas, you may be wondering how to approach depreciation for these assets. This article offers a guide to help you navigate these considerations effectively.

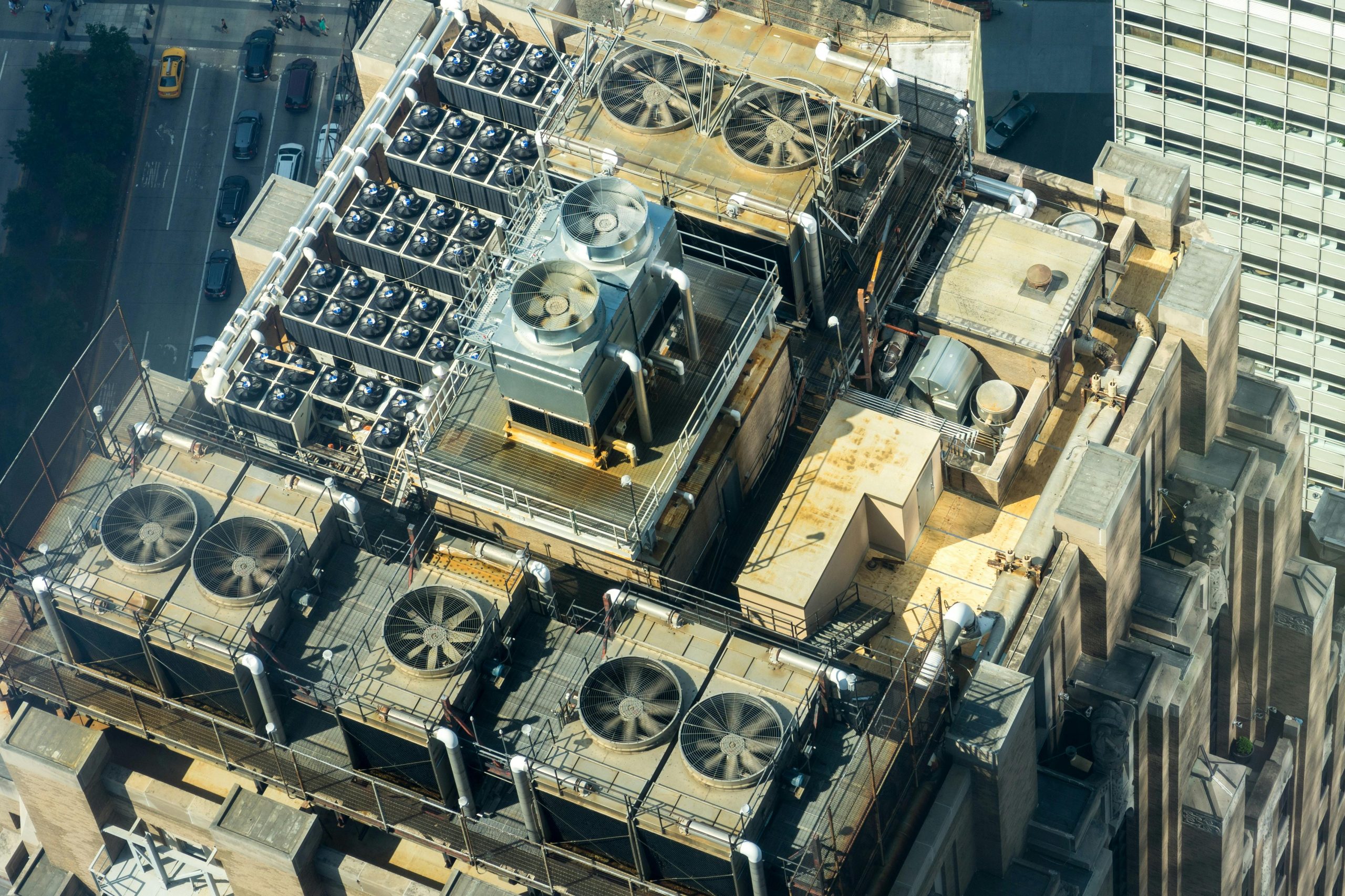

Can You Depreciate Existing HVAC Units?

Yes, in most cases, you can depreciate HVAC units that are part of your newly acquired business premises. Depreciation allows you to spread the cost of certain assets over their useful life, providing tax benefits over time.

Determining the Depreciation Method and Period

-

Asset Valuation:

To depreciate HVAC units, you’ll need to establish their cost basis — that is, the value of the units at the time of your acquisition. If the purchase agreement did not specify the individual prices, you can consider using fair market value estimates or the purchase price allocation provided during the business sale. Consulting with a qualified accountant or tax professional is highly recommended for accurate valuation. -

Useful Life Expectancy:

HVAC systems commonly have an estimated useful life of about 10 to 15 years, depending on usage and maintenance. The Internal Revenue Service (IRS) generally classifies HVAC systems as 15-year property under applicable depreciation schedules.

For practical purposes, many businesses consider a 10-year depreciation cycle, but verifying current IRS guidelines or consulting a tax professional will ensure compliance.

Depreciation of Retail Fixtures: Shelving and Gondolas

Retail fixtures such as shelving units and gondolas are also depreciable assets. These structures typically have a longer useful life, often around 7 to 10 years, depending on their material quality and expected wear.

How to Value Shelving and Gondolas?

-

Initial Cost:

The original purchase price or construction cost of these fixtures provides the basis for depreciation. -

Allocated Value:

If these fixtures were included in the sale without specific prices, you might need to allocate a portion of the total purchase price to fixtures based on an appraisal or a proportional estimate.

Determining Depreciation Schedule

The depreciation period for shelving and gondolas generally ranges from 7 to 10 years. Again, consulting with