Determining Fair Equity Stake in a Pre-MVP Startup: A Guide for Technical Co-Founders

Embarking on a new venture as a technical co-founder can be an exciting opportunity, but it also raises critical questions about compensation and equity sharing, especially in the early stages of startup development. If you have been approached by a startup looking for technical leadership before reaching the minimum viable product (MVP) stage, understanding what constitutes a reasonable equity share is essential.

Scenario Overview

Consider a situation where an experienced software engineer and business professional is approached to join a startup as a technical co-founder. The startup consists of two founders: one with a well-established agency operating for over 15 years, and another with a promising vision for a new product. The founders are optimistic about securing future funding, projecting a valuation of approximately $30 million. However, the current product is in a rudimentary state—developed without proper engineering practices—resulting in a codebase that requires complete redevelopment.

Initial Offer and Negotiations

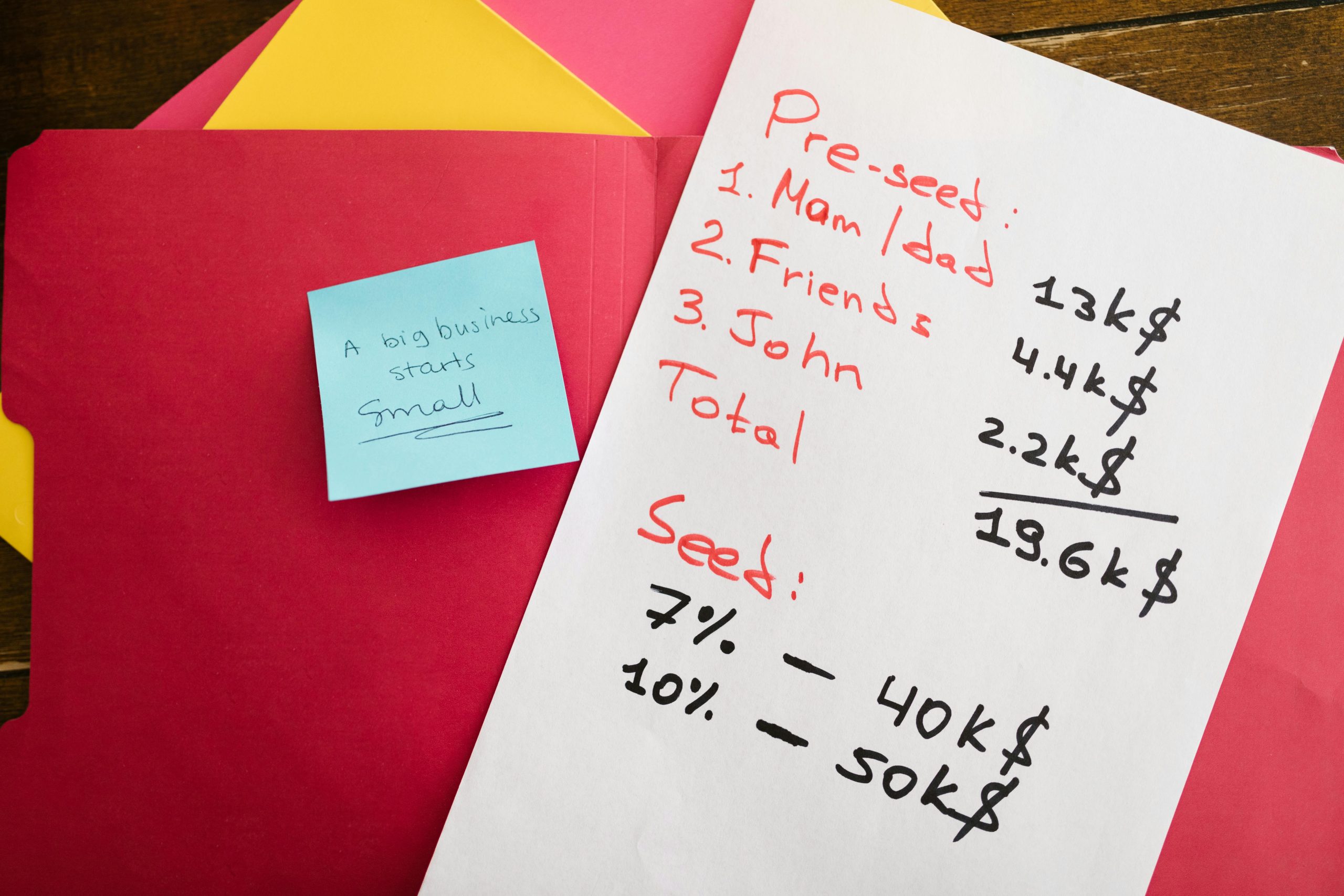

Initially, the technical co-founder was offered a 1% equity stake, vesting over four years. After discussions, this was increased slightly to 2.6%. Importantly, this offer was made without any monetary compensation, relying solely on sweat equity. The founders believe this equity share is fair, considering the absence of paid salary and their confidence in forthcoming funding.

Key Considerations for Equity Valuation

-

Stage of Development: The company is pre-MVP, meaning the product is not yet market-ready. This inherently carries higher risk for founders and early contributors.

-

Product State and Technical Debt: The existing codebase needs a complete overhaul due to poor initial development practices. This represents additional work and risk for the technical co-founder.

-

Founder Contributions and Background: The other founder’s longstanding agency experience adds value, but the technical founder’s expertise in building scalable, reliable products is critical for success.

-

Funding and Valuation Expectations: The founders anticipate significant future funding, with a target valuation of $30 million. Equity distribution should consider potential dilution and future valuation milestones.

-

Market and Industry Standards: Typical equity shares for technical co-founders at pre-MVP stages often range from 1% to 10%, depending on the perceived value, commitment level, and the company’s potential.

Recommendations

- Assess Your Value and Negotiation Power: Consider your unique skills, experience, and the amount